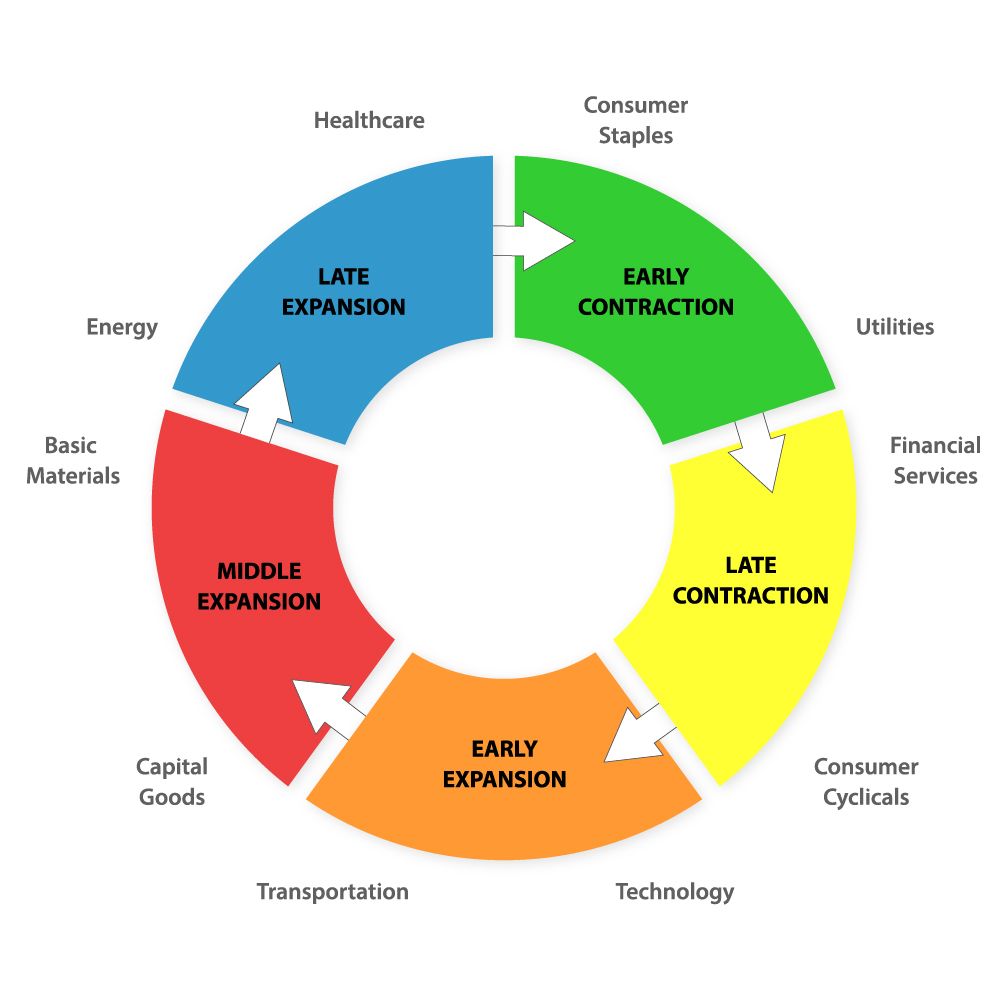

I was reading about sector rotations and wondered why did certain sectors perform better during certain years.

Charlie Munger (in 1994) had mentioned: “However, I know of no really rich sector rotator. Maybe some people can do it. I’m not saying they can’t. All I know is that all the people I know who got rich—and I know a lot of them—did not do it that way.”

It seems like it may not be that easy to play the game of “sector rotation”. But to my understanding, there are people who tried using machine learning to predict the “winners” in this game.

Anyway, together with my friend, we look the the returns of the different sectors in US stock market from 1976 to 2019. It is really a lot of data to look through.

SELECT SECTOR SPDR ETFS

For the year of 2020, we chose to have a look at SPDR ETFs as they offer high liquidity and it is easier to have a look at their recent performance.

S&P 500 Index SPY >>>> Benchmark

Communication Services XLC

Consumer Discretionary XLY

Consumer Staples XLP

Energy XLE

Financials XLF

Health Care XLV

Industrials XLI

Materials XLB

Real Estate XLRE

Technology XLK

Utilities XLU

We are allocating elements (Metal, Water, Wood, Fire, Earth) to each of the sectors. This has gone through vigorous testing as we want to be as accurate as possible. This is critical to identifying which is the sector that will outperform the benchmark during different time period.

FINAL THOUGHTS

The elements identification part has been completed, which has taken us a few months (through a lot of trial and error). The follow-up would be identifying the entry/exit period and ‘attempting to beat the market (benchmark)’.

I have considered what are the possible ways to leverage up the returns in the least risky way. And this would require more fine-tuning.